Comprehend The Facets Of Dry Eye Therapy Insurance Coverage-- Uncover What Your Insurance Could Fall Short To Communicate. Are You All Set For The Connected Expenditures?

Post Composed By-Mack Oneill

When it concerns handling completely dry eye disorder, recognizing your insurance coverage can be a little bit challenging. Not all treatments could be included in your strategy, which can bring about unexpected out-of-pocket costs. While some prescription options might be partly covered, over the counter solutions often aren't. Prior to you continue, it is necessary to recognize what your certain plan sustains. Let's check out the details and help you navigate this facility landscape effectively.

Recognizing Dry Eye Syndrome and Its Treatments

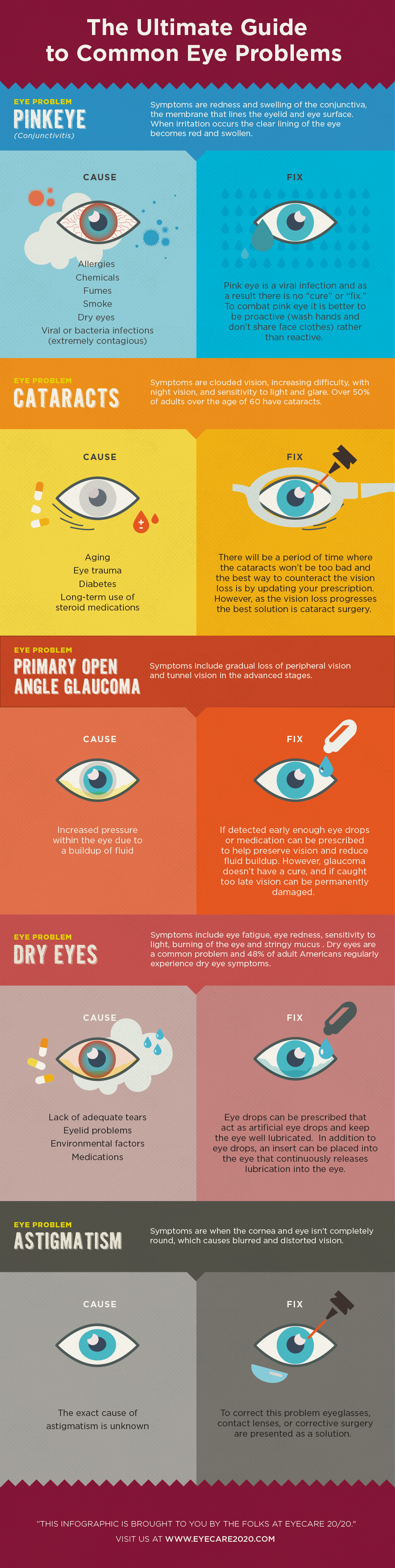

When you experience completely dry eye disorder, it can feel uneasy and irritating. This condition occurs when your eyes can not create sufficient rips or when the rips vaporize too swiftly. You may discover signs like inflammation, redness, and a gritty sensation.

Different treatments are available to help relieve these symptoms. Over-the-counter fabricated splits can lubricate your eyes, while prescription drugs might reduce swelling or increase tear production. Punctal plugs, little devices placed into your tear air ducts, can likewise aid retain dampness.

Way of life adjustments, such as making use of a humidifier or taking breaks from displays, can provide added alleviation. Comprehending these treatments equips you to choose the very best choices for your demands and boost your total convenience.

Insurance Protection for Dry Eye Treatments

Browsing insurance policy protection for dry eye therapies can be challenging, especially given that not all treatments and medications are equally covered. Your strategy might cover prescription eye decreases, yet over-the-counter choices usually aren't included.

It's essential to inspect if your insurance coverage covers specific treatments, like punctal plugs or Lipiflow therapy. Some plans may need pre-authorization or a reference from your eye treatment company, which can include extra steps.

Furthermore, coverage can vary based on whether you see an in-network or out-of-network specialist. Constantly examine helpful resources and talk to your insurance rep to clarify what's consisted of.

Recognizing your insurance coverage helps you make notified choices and handle your dry eye symptoms successfully.

Tips for Navigating Your Insurance Coverage Strategy

Comprehending your insurance policy protection lays the groundwork for successfully handling your dry eye therapy options.

Start by evaluating your policy papers, concentrating on areas connected to eye care and details therapy coverage. Do not hesitate to call your insurance policy company for clarification-- ask about co-pays, deductibles, and any kind of pre-authorization demands for therapies like prescription drops or procedures.

Keep a document of all communications and documents you obtain. When you see your eye care professional, bring your insurance card and inquire about in-network suppliers to reduce prices.

Finally, remain notified about any kind of adjustments to your strategy that could affect your therapy. By being proactive and organized, you can browse your insurance coverage plan better and ensure you obtain the care you need.

Verdict

To conclude, navigating insurance policy protection for completely dry eye treatments can be challenging. It's essential to comprehend which options are covered under your plan, from prescription eye goes down to procedures like punctal plugs. Take the time to review your plan and connect with your insurance coverage carrier to prevent unexpected prices. Staying organized and notified will certainly aid you access the care you require while managing your costs successfully. visit my home page , so do not wait to look for the necessary treatments!